Table Of Contents

What are Accounting Concepts?

Accounting concepts are the basic rules, assumptions, and conditions that define the parameters and constraints within which accounting operates. In other words, accounting concepts are generally accepted accounting principles, which form the fundamental basis of consistently preparing the universal form of financial statements. Accounting concept principles underpin the reliability and integrity of financial information, critical for informed business decisions.

Accounting concepts provide a foundational framework for accurate financial reporting and decision-making. They ensure consistency and transparency in financial statements, making it easier for stakeholders to interpret and compare data. Concepts like the accrual basis of accounting and the going concern assumption help businesses present a true and fair view of their financial health.

Accounting Concepts Explained

Accounting concepts are the generally accepted rules and assumptions that assist accountants in preparing financial statements. In layman's terms, they are the fundamental building blocks of the transactions of the business. In layman terms, they are the fundamental building blocks of the accounting system, with the primary objective of providing uniform and consistent financial information to relevant investors and all the stakeholders. It provides the framework for recording the financial transactions of the business.

Financial accounting concepts, often referred to as accounting principles or GAAP (Generally Accepted Accounting Principles), are a set of fundamental guidelines that govern the field of accounting. These concepts provide a structured framework for recording, reporting, and interpreting financial transactions, ensuring consistency, accuracy, and transparency in financial statements. Here's an overview of some key accounting concepts:

These accounting concepts collectively form the basis for financial reporting, enabling businesses to prepare accurate and reliable financial statements that are useful for various stakeholders, including investors, creditors, and management. Adhering to these principles fosters consistency and transparency in financial reporting, enhancing the credibility of a company's financial information.

To acquire an in-depth knowledge of accounting concepts and also have a look at the advanced level of importance of accounting activities in financial analysis, you can check out this Accounting For Financial Analysts Course quickly.

Objectives

Let us understand the objectives of financial accounting concepts through the explanation below.

- The main objective is to achieve uniformity and consistency in preparing and maintaining financial statements.

- It acts as the underlying principle that assists accountants in preparing and maintaining business records.

- It aims to achieve a common understanding of rules or assumptions to be followed by all types of entities, thereby facilita.

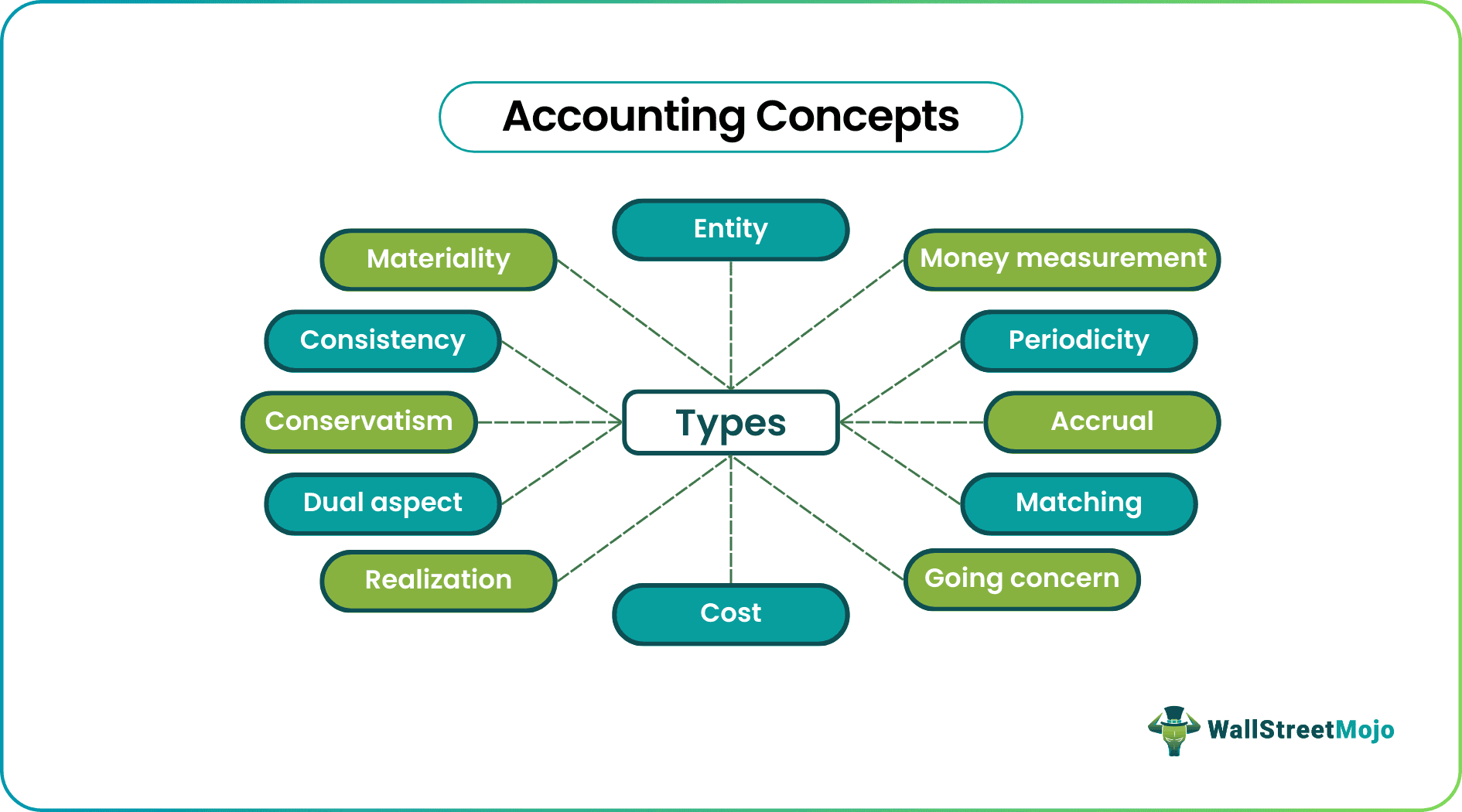

Top 12 Accounting Concepts

Below mentioned are the generally accepted accounting concepts used widely around the world.

#1 - Entity Concept

The entity concept is a concept that explains to you that your business is different from yours. It tells you that the business owner and the owner are two separate entities. The statute recognizes the entity as an artificial person. The entity must prepare its own set of financial statements and record its business transactions accordingly.

#2 - Money Measurement Concept

Money Measurement concept states that only those transactions are recorded and measured in monetary terms. In simple words, only financial transactions are recorded in books of accounts.

#3 - Periodicity Concept

The periodicity concept states that the entity or the business needs to carry out the accounting for a definite period, usually the financial year. The period for drawing financial statements can vary from monthly to quarterly to annually. It helps in identifying any changes occurring over different periods.

#4 - Accrual Concept

According to Accrual Accounting, the transaction is recorded on a mercantile basis. In other words, transactions are to be recorded as and when they occur, not as and when the cash is received or paid, and for the period the transaction pertains.

#5 - Matching Concept

The matching concept is linked to the Periodicity concept and Accrual concept. The matching concept states that during the period for which revenue has been considered, the entity needs to account for expenses only relating to that period. It means that the entity has to record revenue and expenses for the same period

#6 - Going Concern Concept

Going concern concept assumes that the business will be carried out on an ongoing basis. Thus, the books of accounts for the entity are prepared such that the business will be carried on for years to come

#7 - Cost Concept

The cost concept states that any asset that the entity records shall be recorded at historical cost value, i.e., the asset's acquisition cost.

#8 - Realization Concept

This concept is related to the cost concept. The realization concept states that the entity should record an asset at cost until and unless the realizable value of the asset has been realized. Practically, it will be correct to say that the entity will record the realized value of the asset once the asset has been sold or disposed of off, as the case may be.

#9 - Dual Aspect Concept

This concept is the backbone of the double-entry bookkeeping system. It states that every transaction has two aspects, debit and credit. The entity has to record every transaction and give effect to both debit and credit elements.

#10 - Conservatism

This conservatism concept states that the entity needs to prepare and maintain its book of accounts on a prudent basis. Conservatism says that the entity has to provide for any expected losses or expenses; however, it does not recognize future revenue expected.

#11 - Consistency

The accounting policies are followed consistently to achieve the intention of comparing the financial statements of various periods or for that matter of multiple entities.

#12 - Materiality

The materiality concept explains that the financial statements should show all the items having a significant economic effect on the business. It allows ignoring the other concepts if the item to be disclosed has an insignificant impact on the entity's business, and the efforts involved in recording the same are not worthwhile

Importance

Let us understand the importance of incorporating accounting concept principles in any business or organization through the discussion below.

- The importance of the accounting concept is visible in the fact that its application is involved in every step of recording a financial transaction of the entity.

- Following the generally accepted accounting concepts helps save the accountants' time, effort, and energy, as the framework is already set.

- It improves the quality of financial statements and reports concerning the understandability, reliability, relevance, and comparability of such financial statements and reports.

Advantages

Let us discuss the advantages of financial accounting concepts through the points below.

- A detailed and tallied financial information provides information about the asset viz a vis. The liabilities of the entity;

- Useful information to help the management of the entity make an economic decision;

- Provide financial information to the investors and show the financial status of the entity;

- A clear understanding of how every business transaction has been recorded;

- Uniformly accepted financial report – which assists in better understanding of financial information;

Disadvantages

Despite the advantages mentioned above and throughout the articles, there are a few factors that prove to be a disadvantage for businesses. Let us understand them through the explanation below.

- In case of accounting concept is not followed at every step of the recording of financial transactions,

- Chances of omission and misstatements of financial reporting increase;

- Difficult to trace where the exclusion has taken place;

- Wrongly reported financial transactions lead to issues in interpretation and analysis of financial information;

- The financial report is no longer reliable;

- It ousters the scope for the recording of non-monetary transactions;

- It does not provide for reporting of transactions that are not material. However, materiality level is different for different entities, and thus it can ruin the comparability aspect of financial statements of various entities;

- Since it does not allow recognizing of assets at their realizable values, the financial statements do not provide the actual picture of the financial status of the entity.

Accounting Concept vs. Convention

Accounting Concepts

- Refers to a set of rules and assumptions to be followed while recording financial transactions.

- The accounting bodies of the country set the rules and assumptions to be followed, generally in line with internationally accepted accounting policies.

- To be followed at every step of recording the transactions of the business.

- It is a theoretical approach for preparing and maintaining of books of accounts.

Accounting Convention

- It refers to generally accepted practices followed by the accountants.

- Conventions are the implied accounting practices followed by an entity. Any accounting authority does not govern the same; however, there is a general agreement between the accounting bodies to accept the conventions in practice

- To be followed while preparing financial statements of the entity.

- It is a procedural approach that comes into prepared picture post books.

Accounting Concepts Vs Accounting Standards

Accounting Concepts

- Accounting concepts, also known as accounting principles or GAAP (Generally Accepted Accounting Principles), are fundamental guidelines that underpin accounting practices.

- They provide a theoretical framework for accounting, guiding how financial transactions are recorded, reported, and interpreted.

- Accounting concepts are more general and flexible, allowing for some variation in their application to suit different industries and situations.

- Concepts include the accrual basis of accounting, going concern concept, and prudence concept, among others.

Accounting Standards

- Accounting standards are specific rules and regulations issued by accounting bodies or authorities that prescribe how financial transactions should be accounted for in practice.

- They ensure uniformity and consistency in financial reporting across industries and entities.

- Accounting standards are legally binding, requiring businesses to adhere to specific accounting methods and disclosures.

- International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP) are well-known sets of accounting standards.